Kanilsoft specialized in provides a comprehensive Reconciliation platform with 200+ proven use cases that spans across the industries that includes Banking & Financial Services, Retail, and the Oil & Gas segments. The platform in-built ETL transformation engine and universal data connectors to integrates & extract multiple sources and advances ML based matching engine. Platform is capable to deploy on on-prem or any of the cloud frameworks in Realtime/batch at schedule frequencies. Kanilsoft Reconciliation platform Automates the complex reconciliation process and its associated operations and generate the matched and unmatched exceptions. As a unique offering it auto generate the corrective entries to core systems to reduce the manual efforts improve the operation as part of the investigation and resolution of the exceptions.

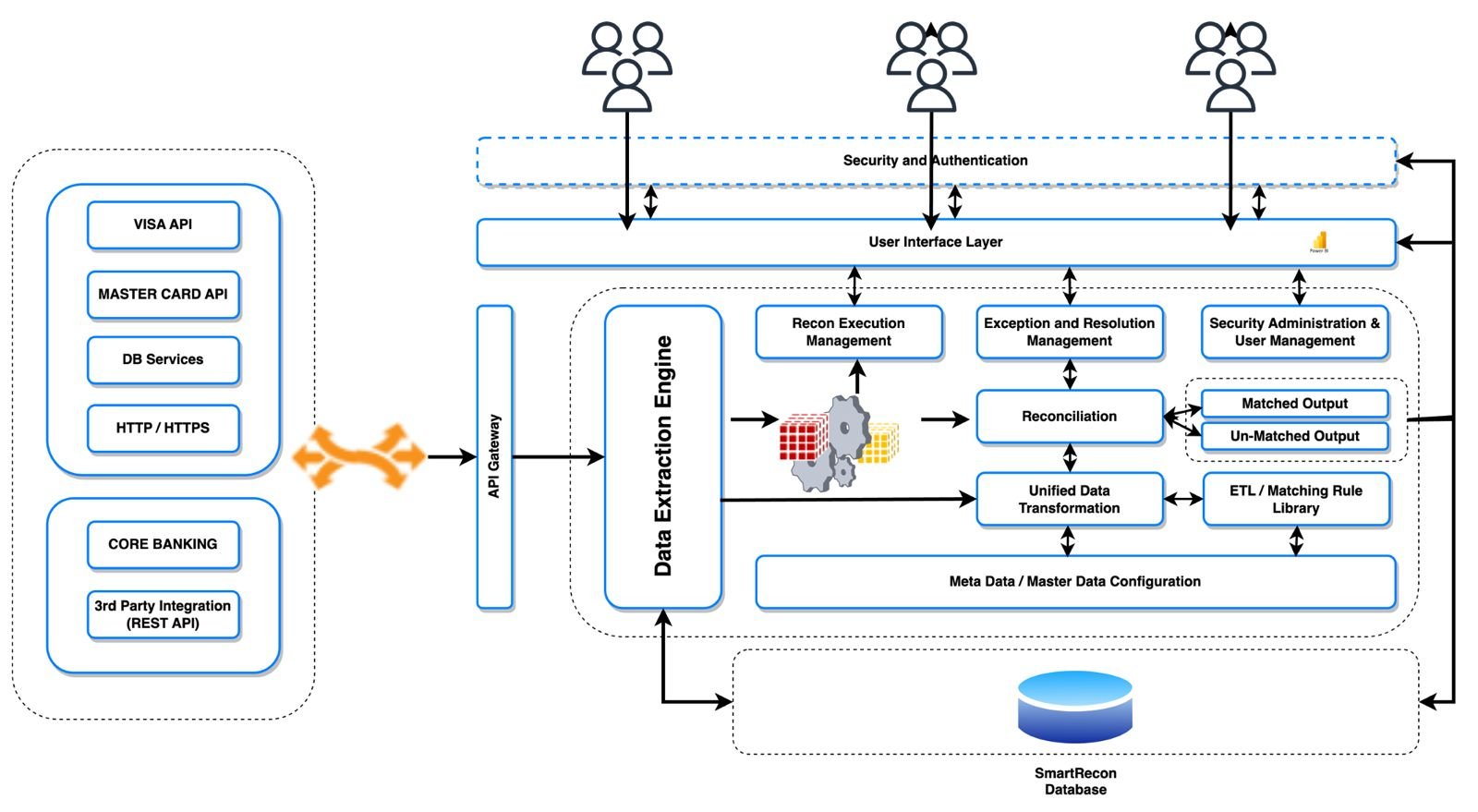

The platform has powerful Data Connectors Engine that offers the data workflows to configure connect and ingest data from various sources. The connectors supported includes file formats like delimiter, fixed length files, Excel, text, structured and Unstructured format, PDF-text and multi-data structure. Platform supports various industry standard formats like SWIFT, MT, MX formats ISO formats and the card networks - VISA, Master card, Rupay and other interchanges. The platforms also provides the integration with various source systems through API gateway also multi DB connectors to extract transform the data using high performance data pipeline Architecture that allows to achieve the faster onboarding of the reconciliation.

The Smart Datafusion rapidly ingests, transforms and process the multiple data source structures as per the business specific requirements. The Smart Datafusion platform auto detects the incoming source data formats using the machine learning algorithms and efficiently loads the data for further enrichment. The in-built Data pipeline framework is capable of processing the large volumes of data using distributed computing architecture that can scale with the volumes. Offers configuration wizard to setup the various ETL rules like formatting rules, validating rules, pattern based lookups and master data based lookups, filters and complex transformation rules and is capable to setup the complex mathematical and computations.

The matching engine provides graphical user interface to orchestrate the complex matching rules that can be contextualized for specific reconciliation processes. The platform offers the N-Way matching capability and allows to setup the Perfect Matching, Partial matching,Tolerance matching , aggregated matching conditions. It supports one-many, many–one, many–many transaction reconciliations models.

Kanilsoft Recon Engine Provides the enhanced user experience to visualize and manage the exceptions. It offers auto generation of the corrective entries as part of the Investigation & Resolution process to reduce the manual operations and ingest into the source system application. It offers the maker and checker and advanced audit trails while performing the force match operations. Allows to setup the User entitlements & permissions at recon level / account level and data level to exercise the grater data security control. Platform has the in-built decision insights and exception analysis and reports to take the corrective actions.

E-mail notifications engine can be contextualized based exception events and generates the alarms and tickets. The email can be scheduled to notify the the reconciliation processes events.

Reports and Analytics : Offers the standard reports, custom reports, operational metrics, escalation metrics, Ageing analysis reports to highlight the outstanding differences and balances. Platform has out of the box reporting & analytical studio to generate the custom dashboards,various insights and compliance reports

Benefit from automated reconciliation systems that effortlessly ensure precision and accuracy in your financial records, reducing manual errors.

Our reconciliation services save you time by streamlining processes, allowing you to focus on strategic financial decisions rather than tedious manual tasks.

Experience the advantage of detailed and comprehensive reporting, providing insights into your financial landscape and facilitating informed decision-making.

Tailor our reconciliation services to your unique business needs, ensuring a personalized and flexible approach that aligns seamlessly with your requirements.

Trust in our commitment to data security, with robust measures in place to safeguard your sensitive financial information throughout the reconciliation process.

As your business grows, our reconciliation solutions scale efficiently, adapting to increased volumes and complexities while maintaining optimal performance.

Our innovative platform is meticulously designed to not only optimize operational processes but also to generate tangible, quantifiable growth. By leveraging cutting-edge strategies, we pave the way for transformative efficiency gains and enhanced portfolio value.